Tuesday, December 14, 2010

Testimony on FY2012 Budget

We strongly encourage ABH members to submit testimony by December 29. I have pasted below a copy of ABH’s testimony. Please feel free to use it as a model for your own comments.

Testimony can be submitted to:

Secretary JudyAnn Bigby, Executive Office of Health and Human Services

One Ashburton Place, Room 1109

Boston, MA 02108

Or emailed to: eohhshearings@massmail.state.ma.us

******************************************************************************

December 9, 2010

Secretary JudyAnn Bigby, M.D.

Executive Office of Health and Human Services

One Ashburton Place, Room 1109

Boston, MA 02108

Re: FY 2012 Budget

Dear Secretary Bigby:

On behalf of the membership of the Association for Behavioral Healthcare (ABH), thank you for the opportunity to comment on FY 2012 budget recommendations for EOHHS and its departments. As you know, ABH is a statewide association representing eighty-nine community-based mental health and substance abuse provider organizations. Our members are the primary providers of publicly-funded behavioral healthcare services in the Commonwealth, serving approximately 117,000 Massachusetts residents daily and employing 22,000 people.

As you consider the FY 2012 budget, we strongly urge you to ensure that community-based behavioral health services are held harmless from further budget cuts.

Stability for the Community Services

Lack of access to critical health care services remains a significant barrier to preventing and treating health disorders before they intensify and require costlier treatment in more intensive settings. ABH providers know from experience that access barriers to community-based mental health and substance use disorder services can be debilitating or even fatal.

While we have been encouraged by the administration’s recognition of the importance of community mental health and substance use disorder services, the community behavioral healthcare system is still struggling with the budget cuts of a few years ago. Thousands of individuals and families are not able to access services and supports for mental health and/or substance use disorders. In light of this unacceptable situation, existing levels of services must be maintained in order to ensure that individuals are able to access needed care and to provide stability for the community behavioral health system to the greatest extent possible.

ABH strongly supports the philosophy of Community First – that whenever possible, individuals should live and be served in community settings, with minimum lengths of stay in acute and continuing care hospitals, and maximum diversion from inpatient care through use of community-based emergency services and alternative levels of care. To achieve the goal of Community First, however, the Commonwealth must commit the financial resources necessary to allow adults and children with mental illness and/or substance use disorders to live successfully in their own communities. ABH and our members believe that current community resources are not sufficient to truly support recovery and resiliency for clients.

Fair and adequate reimbursement rates are the cornerstone of a stable community-based behavioral health system. Inadequate rates directly impact the ability of providers to ensure that clients have access to the services they need to live in their communities. Over the years, the erosion of behavioral health rates has forced providers to make the difficult decision to close clinics or reduce access. As EOHHS considers the FY 2012 budget, it must not ignore this critical issue.

Department of Mental Health

ABH believes that the community-based service system needs to be fundamentally strengthened, and better coordinated to appropriately serve Department of Mental Health (DMH) clients. Providers report serious concerns about their programs’ level of staffing and resulting ability to meet the acute needs of individuals being more rapidly discharged from inpatient care, including for some, following lengthy hospital stays. Issues of medical co-morbidity, forensic involvement, aging, and increasingly complex psychotropic medication needs are further challenges for community services given the limited availability of current resources.

In re-allocating DMH financial resources to open the new DMH hospital, resources must not be taken from already-vulnerable community services. The community-based continuum needs additional resources and staffing. Many individuals being discharged from state hospital beds need specially-focused resources to support their acute needs in the community.

The budget reductions of the past few years have eliminated or dramatically reduced many community services that had served DMH clients. The crisis in outpatient services is perhaps the most high profile example of this problem. In recent years, there has been a significant reduction in outpatient capacity which has reduced access to vital, cost-effective services for individuals with severe and persistent mental illness. DMH and MassHealth need to provide adequate rates for outpatient mental health and sufficient resources to provide the full range of community-based services so that individuals living with mental illness may truly benefit from the Commonwealth’s commitment to Community First.

Adequate funding for the Department of Mental Health (DMH) is essential in order to maintain treatment for individuals across the Commonwealth in need of mental health services. DMH offers individuals with mental illness many critical community-based services that are not available through MassHealth or private insurance. We urge you to maintain funding for the DMH community accounts (line items 5042-5000; 5046-0000; 5046-2000; 5047-0001; and 5055-0000) in order to avoid a shift toward more expensive interventions such as emergency rooms, acute inpatient care and homeless shelters.

Bureau of Substance Abuse Services

While we were disheartened by the results of Question 1 in the November election, we are extremely grateful for Governor Patrick’s commitment to preserve funding for substance use disorder treatment and prevention services for the remainder of FY 2011 which will ensure that 100,000 Massachusetts residents continue to receive the treatment they need to remain in the community and to be productive members of society.

Going forward, we strongly urge you to continue this commitment and maintain funding for the DPH/Bureau of Substance Abuse Services (line items 4512-0200, 4512-0201, 4512-0202, and 4512-0203). These critical substance abuse prevention, treatment and recovery support services are an essential part of the Commonwealth’s safety net and we are sincerely grateful for your continued support. If funding for addiction treatment is cut, access to treatment is reduced, and

the state will end up paying more to serve these clients in emergency rooms, our court system and prison beds.

MassHealth Behavioral Health

Medicaid finances medically necessary behavioral health services for individuals and families and helps ensure stability for some of the most vulnerable individuals in our society. For example, MassHealth psychiatric day treatment services provide essential services for individuals being discharged from state hospitals and help ensure that individuals are able to remain in their communities. In addition, MassHealth behavioral health services also include vital substance use disorder services for individuals across the Commonwealth.

As you know, service implementation for the Children’s Behavioral Health Initiative (CBHI) is underway. As the state continues to work to develop this new system, funding is necessary to ensure successful implementation of the Rosie D. court order. This funding is essential to strengthen our community-based mental health system to better serve children living with Severe Emotional Disturbance (SED) in Massachusetts.

MassHealth behavioral health services do more than keep ill people off the streets; they keep people alive. As such, the Commonwealth must take steps to ensure that these valuable services continue to be available to the state’s residents.

Community-based provider organizations embrace on a daily basis the opportunity to help individuals return to live in the community and begin to recover with the support of homes, jobs, peers, family and friends. Those same organizations, however, find it extremely frustrating and sometimes very troubling to try to do so without the resources necessary to allow individuals to achieve recovery to the fullest extent possible. For these reasons, we look forward to working with the Commonwealth on the difficult challenges that lay ahead.

If you have any questions or comments, I am happy to address them at your convenience. Thank you for your consideration.

Monday, November 1, 2010

DiGravio and Frangules: Liquor stores don't deserve a tax break

Massachusetts voters face a critical choice on Election Day, and not just in the campaign for governor. Question One on the ballot will ask voters to create a special tax exemption for alcohol at retail stores - and slash $110 million from a budget already facing a $2 billion deficit. It's a reckless fiscal and public health policy measure that should be voted down.

If approved, Question 1 would change the state's sales tax law to carve out a special exemption for alcohol sold at retail stores. Alcohol would still be taxed at restaurants and bars. The only items that are exempt from the state's sales tax are basic necessities, like food, clothing and prescription medicines. Alcohol is not a basic necessity and doesn't deserve a tax break.

In radio ads currently running in Massachusetts, proponents of Question 1 argue that residents are flocking to New Hampshire and buying tax-free alcohol there. Aside from the dubious financial wisdom of spending time and gas money on a trip to New Hampshire to buy alcohol, the ads are not true. Actually, sales in New Hampshire are down slightly from their 10-year average of 5.1 percent growth. There has been no spike in alcohol sales in New Hampshire.

However, alcohol sales are up in Massachusetts by 4 percent in the past quarter, according to the Department of Revenue.

As public and fiscal policy, it makes no sense to exempt alcohol from the sales tax. Forty-five other states (all the states that have a sales tax) apply it to alcohol. The Massachusetts alcohol tax is clearly in the mainstream for all states.

Every dollar of the tax goes to essential addiction prevention, treatment and recovery and public health services, through the dedicated Substance Abuse Treatment Fund. This fiscal year, it will bring in about $110 million in revenue to support vital health programs.

The Committee Against Repeal of the Alcohol Tax is a group of more than 160 healthcare, human service, community, union and business groups that have banded together to get out the message about the impact of the alcohol tax repeal.

According to a poll conducted this spring by the Committee, 58 percent of voters are opposed to repeal. A State House News Service poll recently found the numbers had climbed slightly to 60 percent and a Boston Globe poll found similar opposition to the alcohol tax break. But proponents of the repeal are spending over $1 million to secure a Yes vote.

So who's behind Question 1? The liquor industry, which stands alone on this crusade. Not one organization outside the industry has endorsed the campaign or even contributed money to it. Even business associations have spurned the liquor industry. They argue that the state cannot afford the lost revenue, and that it would be unfair to give preferential treatment to alcohol in the state's tax code.

The alcohol sales tax, paid only by those who purchase alcohol, goes directly to a fund for treatment of addiction. We can't afford to repeal this tax. That is why people should vote no on Question 1 on November 2.

Vic DiGravio is president and CEO of the Association of Behavioral Healthcare. Maryanne Frangules is executive director of the Massachusetts Organization for Addiction Recovery. They co-chair the Committee Against Repeal of the Alcohol Tax.

Tuesday, October 19, 2010

Monday, August 2, 2010

Massachusetts passes criminal offender record reform law

“This is for people who made one mistake, who have shown they rehabilitated themselves, to be able to go on with their life,” said Lew Finfer, leader of a coalition lobbying for the changes.

Under the new law, when a defendant is found not guilty, or the case is continued without a finding, the charge will not show up on an employer’s criminal background check. Offenders will have a chance to seal their criminal records with five years of good behavior for a misdemeanor, and 10 years after a felony. Law enforcement agencies will have access to an unedited criminal record, and a sex offender’s records cannot be sealed.

ABH sought the changes to enable persons who have had trouble finding work because of one mistake to get their lives back on track. Many individuals with mental health and/or substance use disorders have criminal records because of the way their illnesses manifest themselves, and the old CORI system impeded their ability to live and work in the community.

In testimony to the Judiciary Committee last year, I stated:

“Access to substance abuse and mental health services, employment opportunities, and the ability to live and thrive in the community are fundamental to the recovery process.”

The Legislature did the right thing in reforming the CORI laws. This was a major step forward for individuals in recovery.

Wednesday, July 7, 2010

Governor Patrick Signs Substance Abuse Treatment Fund into Law

June 30 was a landmark day for the public health community in Massachusetts. Governor Deval Patrick signed the Fiscal Year 2011 budget into law that day, and budget bill included creation of a Substance Abuse Treatment Fund in the Department of Public Health. Proceeds from the alcohol sales tax -- about $110 million this year -- will go into the fund and ensure secure revenues for these critically important services that help more than 100,000 Massachusetts residents.

Friday, June 25, 2010

Association for Behavioral Healthcare Statement on FY 2011 Budget

The Association for Behavioral Healthcare is pleased that the Legislature level-funded some of the most critical behavioral health services provided by the Commonwealth in the FY 2011 budget. In particular, the budget largely protects from cuts essential community-based mental health and substance use disorder treatment services.

The budget plan reflects a fiscally responsible approach to the unique circumstances surrounding the stalemate in Washington over the so-called FMAP reimbursement funds, which could result in an unanticipated $650 million state budget cut. Legislative leaders established a contingency fund that would allocate FMAP funds if and when they become available.

The Legislature also established a separate Substance Abuse Treatment and Prevention Fund, which will collect all proceeds from the alcohol sales tax and dedicate the funds for addiction treatment, prevention and recovery programs that benefit more than 100,000 people in Massachusetts. This marks a significant step forward that will establish a reliable funding source for important public health services.

ABH urges Governor Patrick to sign the budget passed by the Legislature and create the Substance Abuse Treatment and Prevention Fund.

Tuesday, June 8, 2010

Poll Shows 58% of Public Oppose Alcohol Tax Repeal

617-5230038

Jim@sloweymcmanus.com

Poll Shows 58% of Public Oppose Alcohol Tax Repeal

Hundreds Rally at State House to Support Dedicated Treatment Fund

Boston, MA -- June 8, 2010 – By a wide margin, Massachusetts voters oppose repealing the alcohol sales tax, according to a poll released today by the Campaign for Addiction Prevention, Treatment and Recovery, a group of more than 125 public health and behavioral health organizations from across the state that oppose the alcohol tax repeal.

The sales tax on alcohol retail sales is being challenged through a ballot initiative supported by package store owners in November that would repeal the tax.

“Massachusetts residents clearly see the importance of using the alcohol sales tax to support public health services for youths and families,” said Vic DiGravio, and Maryanne Frangules, Co-Chairs of the Campaign. “It is also clear that people understand that the state needs revenues, and there should be no special exemption from the sales tax for alcohol.”

DiGravio is president of the Association for Behavioral Healthcare. Frangules is executive director of Massachusetts Organization for Addiction Recovery.

The poll results were released today at a State House press conference and rally to support creation of a dedicated fund for proceeds from the alcohol sales tax. In the budget for Fiscal Year 2011, the House and Senate created a Substance Abuse Prevention and Treatment Fund, which will dedicate alcohol tax proceeds to such services. The tax is expected to bring in $110 million in its first year.

More than 300 people gathered at the State House today to demonstrate support for the Fund and the services it funds. The supporters heard from Campaign organizers, Senator Steve Tolman (D-Brighton), a major proponent of the Fund in the Legislature, and individuals who are in recovery from alcohol addiction.

Robert L. Monahan, PhD., president of the Recovery Homes Collaborative, spoke at the press conference, along with Elizabeth Rodriquez of Methuen and a student from the Recovery High School in Boston, two consumers who receive services funded in part by the alcohol tax.

The opinion poll released today shows deep and broad opposition to repealing the tax. Sixty-eight percent of women and 49 percent of men said they opposed repeal of the alcohol sales tax. Six percent were undecided.

The poll surveyed the opinions of 450 Massachusetts voters from May 3-5. The margin of error is 4.5 percent. It was conducted by Anderson Opinion Research of Boston.

The poll asked voters: “If the election were held today, would you vote yes or no on a ballot question to remove the state sales tax on alcoholic beverages?”

“There’s strong support for the alcohol tax across the state,” said DiGravio and Frangules. “By using language designed to elicit voters’ attitude toward this specific tax, we were able to obtain an accurate picture of peoples’ attitudes toward the alcohol tax.”

Other findings:

· Democrats oppose the alcohol tax repeal by 72 percent to 21 percent;

· Republicans support the alcohol tax repeal 47 to 45 percent

· For the general sales tax ballot question, which would roll back the state sales tax from 6.25 to 32 percent, 55 support the rollback, and 38 percent are opposed. Six percent are undecided.

During the recent state budget debate, the Campaign supported creation of the dedicated Fund for alcohol tax proceeds. The Fund would become law when Governor Patrick signs the Fiscal Year 2011 budget.

“The Senate and the House of Representatives kept faith with the people of Massachusetts by establishing the Fund for the alcohol tax, to make sure proceeds go to public health and treatment programs,” said DiGravio and Frangules. “We urge the Governor to sign the Fund into law and create a stable funding source for these critical programs.”

###

Thursday, May 20, 2010

The Campaign for Addiction, Prevention Treatment and Recovery's Statement on Senate Ways and Means Committee Budget

In today's Ways & Means Committee budget, the State Senate demonstrated its commitment to preserving addiction prevention and treatment and services for more than 100,000 Massachusetts residents. Critical programs across the state, from youth intervention and residential treatment services to jail diversion and counseling programs, were funded at sufficient levels in the Senate spending plan for the upcoming fiscal year.

In addition, the Senate, like the House, created a separate Commonwealth Substance Abuse Treatment and Prevention Fund that will ensure proceeds from the retail tax on alcohol are dedicated to these services. We applaud Senate President Murray, Chairman Panagiotakos and the Committee for establishing the Fund and making clear their determination to protect alcohol tax revenues for worthwhile public health and safety services.

Until last year, alcohol sold in stores was exempt from the sales tax just like basic necessities such as food, clothing and prescription medications. The legislature rightly repealed that special tax break and used the proceeds to protect vital public health programs that promote treatment and recovery.

The alcohol retail sales tax, which will bring in $110 million in its first year, is a badly needed source of revenue that supports critically important programs. We appreciate the efforts of the Senate to preserve programs that have such a positive benefit for thousands of families across the state.

Monday, May 17, 2010

Taunton Gazette Guest Opinion: Alcohol tax helps save lives at prom season

By Vic DiGravio and Maryanne Frangules

May 13, 2010

Across Massachusetts, tens of thousands of high school juniors and seniors — including a couple hundred in Taunton tonight — are engaged in the time-honored traditions associated with the prom. Choosing dresses, renting tuxedos, washing cars, buying corsages — it's a rite of passage that provokes anxiety for everyone concerned. Especially parents.

Safety has always been a prime concern around prom season, because many teens associate prom with drinking — frequently binge drinking. And far too many, still, end up getting behind the wheel of a car after consuming alcohol.

Local school and law enforcement officials are reaching out to thwart drunk driving around prom season by an aggressive campaign of education and prevention. In Norfolk County, the Avon Coalition for Every Student released a survey showing that alcohol-use and binge drinking rates have dropped in recent years. While those numbers remain too high, the survey may help alleviate peer pressure by showing that not everyone drinks.

In Western Massachusetts, the Pittsfield Prevention Partnership, in collaboration with MADD Massachusetts, will launch the Prom Season Sticker Shock Campaign at area liquor stores.

The campaign consists of teams of young people, accompanied by an adult chaperone, placing stickers on multi-packs of alcoholic beverages (beer, wine coolers, etc.) and paper bags at participating package stores. The stickers read, “Hey You!! It is ILLEGAL to provide alcohol for people under 21!”

These and many other programs at the state and local level received a boost last year with passage of the alcohol sales tax at retail stores. The tax will bring in about $110 million this year — a drop in the bucket weighed against the billions of dollars in lost productivity, healthcare, counseling and law enforcement costs tied to alcohol and drug abuse.

The retail sales tax on alcohol funds services targeting underage drinkers such as the substance abuse hotline, youth intervention services, residential programs and recovery homes and driver education classes following OUI arrests.

For underage drinkers, alcohol’s toll is tragic. Recent federal statistics show that Massachusetts is among the highest of all states for past month’s alcohol use by underage drinkers — 32.1 to 40.5 percent of 12 to 20 year olds — and that 8.4 to 10.1 percent of those youth purchased the alcohol themselves.

Underage drinking remains a serious problem and requires constant vigilance by families, local and state officials. According to the

most recent data for Massachusetts students in grades 9-12:

• 46 percent had at least one drink of alcohol on one or more occasion in the past 30 days;

• 28 percent had five or more drinks of alcohol in a row (i.e. binge drinking) in the past 30 days;

• 5 percent had at least one drink of alcohol on school property on one or more of the past 30 days.

Despite the ongoing social, healthcare and law enforcement problems associated with addiction, the alcohol industry is pushing a

ballot question this fall to repeal the alcohol retail sales tax.

Those who have struggled with addiction understand that youths need all the help they can get to avoid destructive behaviors. We

need the resources to provide that help, and the alcohol retail sales tax is part of the solution.

Vic DiGravio and Maryanne Frangules co-chair the Campaign for Addiction Prevention, Treatment and Recovery, which seeks to retain the retail sales tax on alcohol.

Friday, April 23, 2010

Mass. House Budget Debate Starts Monday April 26

Action Requested

Ask your Representative to oppose the following amendments:

-- Amendment 40, which would eliminate the Substance Abuse Prevention and Treatment Fund. This fund is created by the House Ways and Means FY 2011 budget and is credited with sales tax revenue from the sales tax on alcohol.

-- Amendment 43, which would eliminate the sales tax on alcohol. The sales tax on alcohol is estimated to raise about $110 million to support substance abuse treatment and prevention. In addition, using taxes to raise prices on alcohol is among the most effective deterrents to drinking and underage binge drinking that researchers have discovered; it is better than law enforcement, media campaigns or school programs.

Ask your Representative to support the following amendments:

-- Amendment 604, to restore $3.2 million to the Department of Mental Health Adult Community Services account (line item 5046-000). $3.2 million would provide funding for the P.A.C.T. (Program for Assertive Community Treatment) teams in Metro Boston and Western Massachusetts Homeless Community Support/Emergency Psychiatric Services;

-- Amendment 447, Amendment 469, and Amendment 530 to restore funding for the human services salary reserve. The salary reserve would be funded at $28,000,000 and would allow for modest but essential salary increases for human service workers earning less than $40,000.

Log on to http://capwiz.com/mhsacm/home/ for more information.

Friday, April 16, 2010

Kudos!

Nationally, only 10 percent of individuals in need of addiction services actually are in treatment. The alcohol sales tax addresses some of that gap by creating a funding source for new problems.

For the thousands of people in Massachusetts whose families have been affected by addiction, the Substance Abuse Prevention and Treatment Fund is smart public policy and sound health policy.

Tuesday, April 13, 2010

Sarah Iselin, CEO of the Blue Cross Blue Shield Foundation, and Amy Whitcomb Slemmer, Executive Director of Healthcare for All, outlined their respective visions for the near term future of payment reform. They did a great job, particularly in the lively Q&A section of the forum. Many members expressed reservations about the prospects for behavioral health under potential reforms.

ABH has outlined four core points as the GPR debate progresses:

1. Behavioral healthcare is a core service and any changes must include systems that allow for better integration of primary and behavioral healthcare.

2. Cost of care considerations must take account of the prevalence of co-morbid medical illness in individuals with substance use disorders and mental illness.

3. Accountable Care Organizations must protect the interests of the most vulnerable populations, including adults and children with behavioral health disorders. Inclusion of community-based behavioral healthcare providers is essential in healthcare system redesign.

4. The transition to a new payment system must be carefully implemented and adequately funded.

Stay tuned for more on this debate in the coming months.

Statehouse Rally Backs Expanded Treatment Services

During the rally, I had the privilege of introducing State Sen. Steve Tolman, (D-Brighton), who sponsored the bill and chaired the Oxycontin and Heroin Commission. Sen. Tolman has aggressively pursued the development of local and state policies to increase awareness of the crisis and the need for more addiction treatment services.

The bill is supported by a report released last November by the Oxycontin and Heroin Commission. While support for addiction treatment programs has increased, the close to 3,300 opiate-realted deaths (from 2002-2007) is proof that we have not sufficiently met the needs for this growing problem. Today's event showed that, with the support of the community and legislative leadership, we can tackle this problem.

Monday, March 29, 2010

Monday, March 22, 2010

Report from National Council for Community Behavioral Healthcare Conference

Former Governor, presidential candidate and MD, Howard Dean, gave a very insightful speech about the politics and substance of health care reform. Trained as a primary care provider, Governor Dean spoke eloquently about the need to better align incentives for the integration of primary and behavioral health care. He clearly sees payment reform as a promising vehicle to accomplish this task.

A few folks from Massachusetts joined me at a riveting and moving session led by Marshele Waddell, the wife of retired Navy Seal Commander Mark Waddell. Mrs. Waddell spoke movingly of her husband's struggles with Post-Traumatic Stress Disorder after repeated deployments to Iraq and of the tremendous impact his struggles had on her and their children. Both Marshele and Mark now work with their local community mental health center in Colorado to help other veterans and their families confront the difficulties many veterans experience returning from war zones in Iraq and Afghanistan.

On a lighter note, I was honored to be joined by ABH board members Kathy Wilson and Norma Finkelstein, along with ABH Senior Director of Public Policy and Research Stephanie Hirst, in accepting an award for Excellence in Grassroots Advocacy at the Gala event on Tuesday night of the conference. ABH was recognized with this national award for our work in organizing and leading the Coalition for Addiction Prevention Treatment and Recovery and our successful effort to repeal the sales tax exemption on alcohol sold in stores. It was very exciting for ABH to be recognized in front of our colleagues from about the nation.

Monday, March 8, 2010

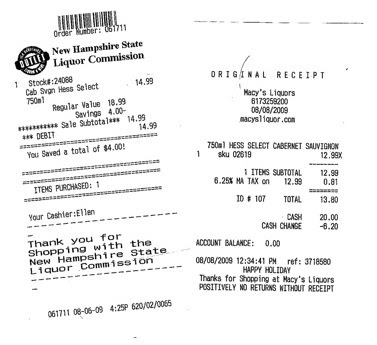

Cheaper in New Hampshire? You better check the receipt.

It seems the alcohol sales tax has not had quite the dramatic effect on prices that some package store owners would have you think. A friend recently sent me two receipts from their favorite wine: one from Massachusetts, the other from New Hampshire. Both bottles were purchased in August -- after the Massachusetts tax took effect.

It seems the alcohol sales tax has not had quite the dramatic effect on prices that some package store owners would have you think. A friend recently sent me two receipts from their favorite wine: one from Massachusetts, the other from New Hampshire. Both bottles were purchased in August -- after the Massachusetts tax took effect. So this consumer paid the Massachusetts alcohol sales tax, and still saved $1.19 on a single bottle of wine. He would have saved $5.19 a week later. In real life, the alcohol sales tax works for Massachusetts.

ABH testimony on Fiscal Year 2011 budget before House Ways & Means Committee, March 5, 2010

While we realize that you will be faced with many difficult decisions in the coming weeks and months, we strongly urge you to hold community-based mental health and substance use disorder services harmless from further cuts.

STABILITY FOR COMMUNITY SERVICES

Lack of access to critical health care services remains a significant barrier to preventing and treating health disorders before they intensify and require costlier treatment in more intensive settings. ABH providers know from experience that access barriers to community-based mental health and substance use disorder services can be debilitating or even fatal.

While we have been encouraged by the Legislature’s recognition of the importance of community mental health and substance use disorder services, the community behavioral healthcare system has not yet recovered from the budget cuts of a few years ago, not to mention the mid-year cuts sustained in FY 2009. Thousands of individuals and families are not able to access services and supports for mental health and/or substance use disorders. In light of this unacceptable situation, current levels of services must be maintained in order to ensure that individuals are able to access needed care and to provide stability for the community behavioral health system.

DEPARTMENT OF MENTAL HEALTH

The Department of Mental Health has cut funding for community based services by over $10 million during the current fiscal year, including the elimination of two Programs for Assertive Community Treatment (PACT) teams and a reduction of over $8 million in funding for Community Based Flexible Supports (CBFS) through the Department’s reprocurement process. Adequate funding is absolutely essential in order to ensure access to appropriate community services for clients who are being discharged from Westborough State Hospital and the inpatient unit at Quincy Mental Health Center and for the system to adjust to the new community based system of care (Community Based Flexible Supports). Therefore, preservation of funding for the Department of Mental Health (DMH) is essential in order to maintain treatment for individuals across the Commonwealth in need of mental health services. DMH offers individuals with mental illness many critical community-based services that are not available through MassHealth or private insurance, including CBFS, Clubhouses, PACT, and Respite.

We urge you to maintain funding for the DMH community accounts (line items 5042-5000; 5046-0000; 5046-2000; 5047-0001; and 5055-0000) in order to avoid a shift toward more expensive interventions such as emergency rooms, acute inpatient care and homeless shelters. In addition to maintaining existing services, additional funding for community based services will be required if the Department proceeds with further reductions to DMH inpatient capacity. According to the final report of the DMH Inpatient Study Commission, The community system must be strengthened. Community based services have been the heart of the DMH service delivery system for more than 30 years. Previous state hospital closings have succeeded as consumers were transitioned to high-quality services in or near their own communities. The community system, however, experienced significant mid-year “9C” budget cuts in October 2008. An investment of funding for community services is necessary for DMH to replicate the success of earlier hospital closings.1 Individuals affected by this will require intensive care if they are to be served in community settings. Currently, the community system does not have sufficient funding and resources to serve these individuals. Funding for community services must be increased dramatically to meet the needs of DMH clients who may be moved from hospitals to community settings in fiscal year 2011.

BUREAU OF SUBSTANCE ABUSE SERVICES The passage of the alcohol sales tax demonstrated a spirit of collaboration between the Legislature, the Administration and all citizens to use these new revenues to preserve funding for substance use disorder services and to retain access to treatment. We ask that the Legislature hold true to the intent of that legislation, and keep faith with the spirit of the initial proposal by dedicating the revenues to a Substance Abuse Health Protection Fund to provide funding or supplement existing funding for a comprehensive continuum of substance abuse care. The need for such a fund has become even more urgent given that the initiative petition to repeal the sales tax on alcohol has received enough signatures to appear on the November 2010 ballot.

Furthermore, we strongly urge you to preserve existing funding for the DPH/Bureau of Substance Abuse Services (line items 4512-0200, 4512-0201, 4512-0202, and 4512-0203). As it stands now, the demand for substance use disorder treatment exceeds capacity and during difficult economic times, demand for treatment increases. In times such as these, it becomes even more essential to protect substance use disorder treatment and services. When funding for treatment is cut, access to treatment is reduced, and the state will end up paying more to serve these clients in emergency rooms, our court system and prison beds.

MASSHEALTH BEHAVIORAL HEALTH

As you know, Medicaid finances medically necessary behavioral health services for individuals and families and helps ensure stability for some of the most vulnerable individuals in our society. For example, MassHealth psychiatric day treatment services provide essential services for individuals being discharged from state hospitals and help ensure that individuals are able to remain in their communities. In addition, MassHealth behavioral health services also include vital substance use disorder services for individuals across the Commonwealth.

As you know, service implementation for the Children’s Behavioral Health Initiative (CBHI) is underway. As the state continues to work to develop this new system, funding is necessary to ensure successful implementation of the Rosie D. court order. This funding is essential to strengthen our community-based mental health system to better serve children living with Severe Emotional Disturbance (SED) in Massachusetts.

Furthermore, behavioral health services must continue to be exempt from MassHealth co-payments. We are concerned that increased cost-sharing will limit access to care. While this issue affects all individuals with significant healthcare needs, it is particularly burdensome for those with behavioral health needs because treatment is often necessary several times per week, as is the case with medication management in conjunction with therapy services, or even daily, as is the case with methadone maintenance treatment. MassHealth outpatient services will be one of the core services for CBHI and co-payments will serve as an additional barrier to treatment. In addition, children’s services routinely involve multiple family members in successive visits, and multiple co-payments can be an insurmountable economic burden for some families. If cost-sharing becomes a major obstacle, individuals will be forced to wait until the illness is more acute, resulting in increased use of higher, costlier levels of care. High out-of-pocket costs will only serve to prevent necessary treatment and exacerbate the stigma faced by individuals with behavioral health disorders.

MassHealth behavioral health services do more than keep ill people off the streets; they keep people alive. As such, the Commonwealth must take steps to ensure that these valuable services continue to be available to the state’s residents.

IMPLEMENTATION OF CHAPTER 257 OF THE ACTS OF 2008

Chapter 257 of the Acts of 2008 (formerly S. 2764) must be adequately funded. At a minimum, we ask that you include a reserve account to fund potential rate increases for the portion of the purchase of service system whose rates must be adjusted by October 1, 2010. Adequately funding Chapter 257 must be a priority and is essential in order to address currently underfunded existing contracts and improve the precarious condition of many provider organizations.

Human Services Salary Reserve

While we recognize that implementation of Chapter 257 will, over time, rectify the fact that human service employees are too often among the Commonwealth’s working poor who struggle to meet basic needs; we are asking you to level-fund the salary reserve at $28 million until the new law is fully implemented. This is a modest request to assist direct support staff making less than $40,000 per year as they struggle with the condition of our state’s economy.

If you have any questions or comments, I am happy to address them at your convenience. Thank you for your consideration.

Friday, February 12, 2010

Positive effects of the new alcohol tax: Letter to the Editor in Brockton Enterprise

In a Jan. 30 Enterprise article on the state alcohol tax, it was declared, "If you bought a six-pack of Sam Adams or a bottle of chardonnay at a store in the past six months, you've probably noticed this tax." But what they may not have realized are the positive effects of the alcohol tax.

Due to the revenue generated from the alcohol sales tax, access to alcohol and drug addiction treatment services has not been significantly reduced this year. This is vitally important because even when the economy was strong, the funding for alcohol and drug treatment services was severely inadequate in meeting the needs of the Commonwealth's citizenry.

Indeed, our agency, High Point Treatment Center, turns away individuals and families seeking services every day due to lack of resources to expand the number of treatment beds and counseling services. Last year alone in the City of Brockton, we admitted more than one thousand individuals for substance abuse treatment services to our community-based program. Sadly, we turned away hundreds more. Simply put, the alcohol tax ensures ongoing access to treatment services.

Often, out of desperation, due to a lack of enough community treatment beds, more families are finding themselves with no other recourse but to turn to the courts for assistance. Last year, more than 1,600 men and women were civilly committed by the courts to High Point.

According to recent Dept. of Public Health data, over 100,000 Massachusetts residents availed themselves of addiction treatment services. It is reasonable to state that for every person treated, at least 10 people who care about that individual are also affected. Ultimately, over a million people are therefore impacted.

The small alcohol sales tax (which still puts our tax rate lower than most New England states) serves an important purpose. Hopefully, through education, the consumer purchasing that six-pack of beer or bottle of chardonnay will agree that the alcohol sales tax is a small price to pay for the enormous positive effects on our state.

Daniel S. Mumbauer,

President & CEO

High Point Treatment Center

Brockton

Wednesday, January 27, 2010

Thoughts on the Governor's 2011 Budget

Unfortunately, other human service programs were not quite as fortunate. We share the concern of many in our industry about the impact of proposed cuts in services for other vulnerable populations.

We all need to be prepared for a long, tough budget fight as the Legislature reviews and acts on the Governor’s recommendations. In a tough election year, legislators will be under a lot of pressure to limit state spending. Advocates, providers, consumers and family members need to be prepared to remind local legislators about the importance of programs that serve individuals with behavioral health needs. ABH looks forward to working with our members and coalition partners to protect existing funding for DMH, DPH/BSAS, and MassHealth.

Friday, January 8, 2010

Happy New Year?

Also, we have the very real prospect of a ballot campaign, organized by the state's package store owners, to repeal the sales tax on alcohol sold in retail stores. ABH will be on the front lines of that battle.

It took decades to get the sales tax exemption for package stores repealed, and we're not going backward now! The Legislature must act on the alcohol tax repeal measure by May 4. If they do not vote, or vote it down, then proponents can gather another 10,099 signatures to secure a spot on the ballot November 2.

All in all, it appears 2010 will be busy year. We welcome and appreciate your help!